nfa tax stamp trust vs individual

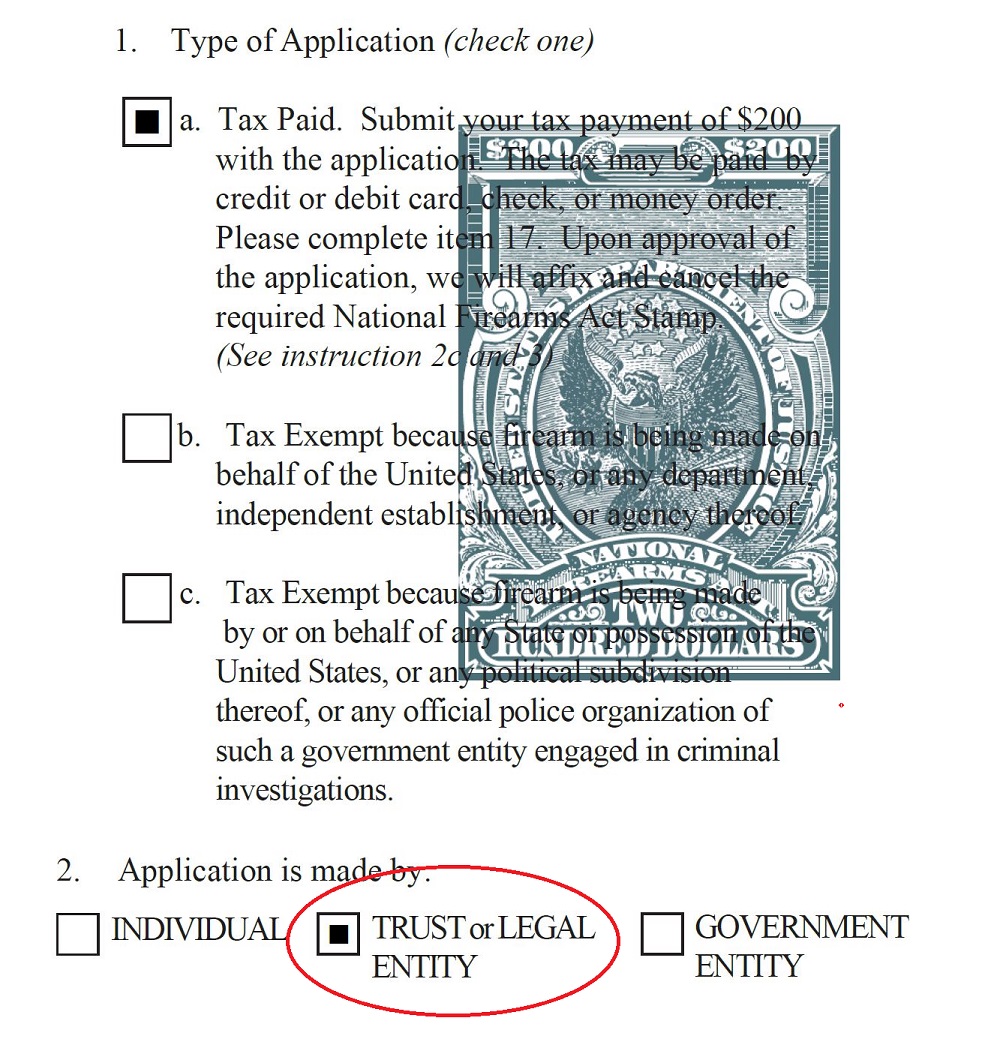

This was a holdover from the days when the NFA was created as it used to serve as your background. Boxes 4a through 4h should be copied directly from the current individual tax stamp.

How To Create Nfa Trust And E File Atf Form 1 For Suppressor Sbr Build Youtube

There qre two main reasons.

. Box 3d and 3e should usually be left blank. Yes The Tax Stamp is for the ability to transfer a Title II firearms to an individual business entity or trust. Tracking and reporting NFA Form 1 and Form 4 transfer times reported by users.

March 17 2020. A tax stamp is required for a non-FFLSOT to possess any NFA Firearm. E-filing and if whether or not the form is filed in the name of an individual corporation trust or dealer-to-dealer transfer.

The most common ATF forms for NFA firearms are the ATF Form 1 ATF Form 3 and ATF Form 4. One DOES NOT list on Schedule A a firearm or receiver that is intended to be converted into SBR. NFA Trust vs.

A Buyers Guide. This sort of simplicity and flexibility is worth so much more than the 2495 cost of the Single Shot Trust. When they wish to register another NFA firearm they avoid the need to remove people from an existing trust by just creating a new trust.

In the majority of states however it is currently perfectly legal for a citizen to possess a silencer suppressor machine gun made before 1986 short barreled rifle short barreled shotgun or an any other weapon as long as the federal requirements were met. That sucks but it is the very reason we can use trusts in the first place. Yes you can transfer your individual tax stamp into a gun trust corporation or other legal entity.

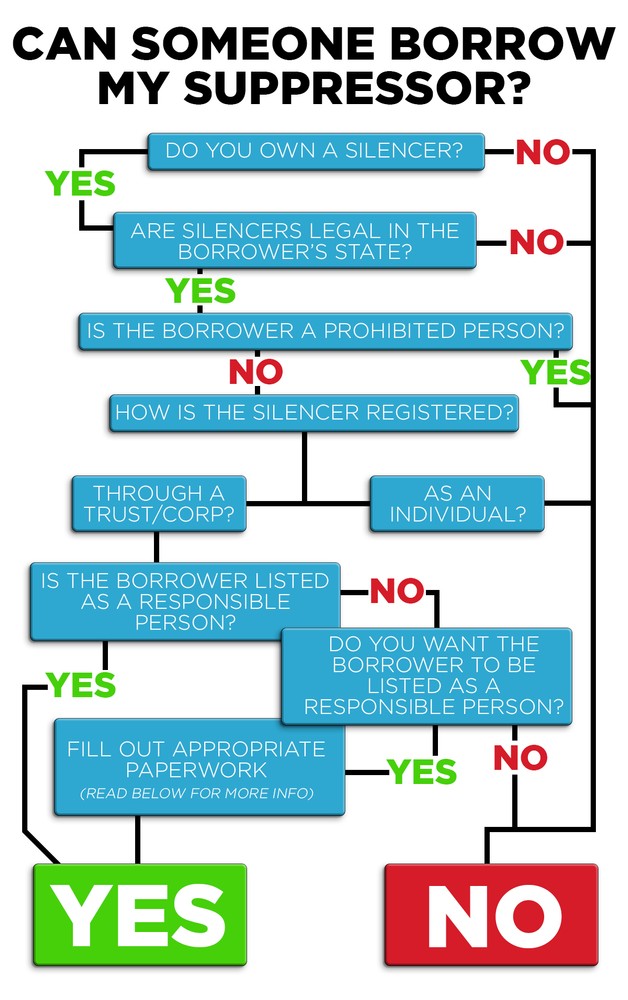

Without a Trust the person that got the Tax Stamp and purchased the suppressor MUST BE PRESENT and in possession of the suppressor when it is being used by another person. Say that on June 15th 2016- there were 200 trusts filings and 70 individual filings. But keep in mind if you buy your Silencer or SBR from an.

The National Firearms Act of 1934 NFA regulated the class 3 firearms above and required their registration along with the. An individual NFA transfer on a Form 4 even if you use a trust requires a 10-month plus wait for ATF approval and the payment of a tax usually 200. Use a revocable trust so that youre not transferring the NFA item.

For FFLs a once a year tax is paid instead which makes the FFL a Special Occupational Taxpayer SOT and a tax stamp for each item is not required. Trustees can handle the item which is still owned by the grantor by virtue of using a fully revocable trust. Jump to Latest Follow 1 - 13 of 13 Posts.

However with a Trust any Co-Trustee can use the suppressor. This is because the trust is a legal person under title II of the CGA of 68. If it was an individual they would have to form 4 it pay 200 and wait for approval.

And yes transferring an individually owned NFA firearm into a trust does require a new tax stamp. Each purchase of an NFA item requires a 20000 tax stamp to the ATF so if you have. They are by far the easiest way to register a single item in a trust.

Whether you purchase a suppressor as an individual or through a trust you submit your Form 4 and 200 for the tax stamp wait about eight months for your paperwork to clear and then you own your suppressor. The Silencer Shop Single Shot Trust is simpler and less expensive than any other NFA trust available. Stamp approved today 52722 431 Days from date of cashing check to have stamp and can in hand 2nd can took 252 days from the date of cashing the check to have stamp and can in hand Both were Single.

Of course if you plan to eventually buy 5 NFA items you do Silencer Shop also offers a Single Shot Unlimited Trust for 12995. A transfer to the trust is the same as a transfer to some stranger. Heres what these forms are used for.

It will be transferred to the trust AFTER getting the tax stamp. In a few states it is unlawful to possess an NFA firearm. At just 25 Single Shot Trusts are a cost-effective way to get the advantages and flexibility of a trust with the simplicity of registering as an individual.

Or a Short Barreled Rifle Short Barreled Shotgun or AOW. I was agreeing that for the two form types to be at pace with one another more filings would have to be reviewed and processed to catch up to the amount of individual forms. Trusts vs Individual Ownership.

Box 3a should contain your name exactly as it appears on the current individual tax stamp and your current mailing address. 1-estate planning if you die and need to pass on all your nfa items adding your kids to the tust is pretty easy to do ahead of time. At 200 a pop.

The requirement of a tax stamp is triggered by a transfer Be careful because ATF treats foot-faults in compliance as if they were crimes. Box 3c should contain your telephone number. Choosing how you should register a suppressor is one of the most common questions we get.

In most cases the Tax Stamp is 200 but if you purchase an AOW the Tax Stamp is only 5. A trust makes it easier to share the fun and benefits of shooting with suppressors. The 10 Steps required for getting your Tax Stamp are.

Just called ATF 304-616-4500 and got it all explained. The ratio of trust to individuals would be different. If its a new trust and it does not own any NFA items yet just submit an empty Schedule A.

Purchase your Silencer or SBR. 2 Do I have to pay the 20000 tax stamp if I have a Gun Trust. In most cases the Tax Stamp is 200 but if you purchase an AOW the Tax Stamp is only 5.

Box 3b should contain your email address. The processing time can depend on the filing method paper vs. The Ways To Register A Silencer.

You can purchase your Silencer or SBR from a gun store online wholesaler individual or other gun trust. As the name implies this all-you-can-eat plan means you get unlimited Single Shot Trusts after that one. There is no discount or change in the Tax Stamp for a Trust.

Create your NFA Gun Trust. Are trusts still the best options for purchasing NFA-regulated items like suppressors SBRs and full-auto firearms. Mainly with trusts it is owned by the entity the trust and there for able to transfer to a family member if you die a little easier by just adding them to the trust.

In fact you can buy NFA Firearms just about anywhere. After ATF issues the tax stamp they can use their customized Gun Trust USA forms to appoint to the trust other people who will then be authorized to possess that trusts single NFA firearm. If my dad is on my trust i dont need to.

In this article we go over the benefits and disadvantages of applying for a NFA Tax Stamp as an individual or a NFA Gun Trust. By National Gun Trusts September 14 2020. 2-qllowing other people to use your nfa item.

Dedicated to the NFA community and 2nd amendment supporters. However since you are transferring the NFA firearm from one entity yourself to a different entity your gun trust corporation or other legal entity you will need to pay the ATF the 200 tax. Trustees can handle the item which is still owned by the.

A Buyer S Guide Individual Vs Trust

How To Fill Out Atf Form 1 Employer Identification Number Form Filling

Single Shot Trust Vs Unlimited Nfa Gun Trusts National Gun Trusts

Nfa Firearms Trust Capitol Armory

Passport Photos For Atf Tax Stamp Applications National Gun Trusts

Silencer Shop Single Shot Trust Vs Nfa Trust

Ffl Sot Vs Gun Trust Or Corporation R Nfa

What Is A Gun Trust The Lodge At Ammotogo Com

Why Choose A Nfa Gun Trust Instead Of Filing Individually For Your Atf National Gun Trusts

Why Have A Gun Trust Estate Planning Lawyers In Sarasota Fl Manasota Elder Law

Silencer Shop S Single Shot Trust Explained And Compared The Truth About Guns

Who Is Allowed To Shoot Or Use My Silencer

Best Nfa Gun Trusts 2022 Should You Get One Gun University

How To Get A Suppressor Tax Stamp

Gun Trusts 14 Points Why A Gun Trust Is The Best Way To Get Your Nfa Item

New Updated 2022 Atf Eform 1 Gun Trust Sbr Video Walk Through Guide National Gun Trusts Youtube

A Buyer S Guide Individual Vs Trust

Atf Tax Stamp Application Process Flow Chart National Gun Trusts